Successful investors are always looking for incremental information advantages in their quest to generate superior returns for their clients. In our world, where natural resources are increasingly constrained, we believe that a company’s environmental productivity (EP) is an essential piece of data that all investors should consider when researching any compa- ny for inclusion in portfolios.

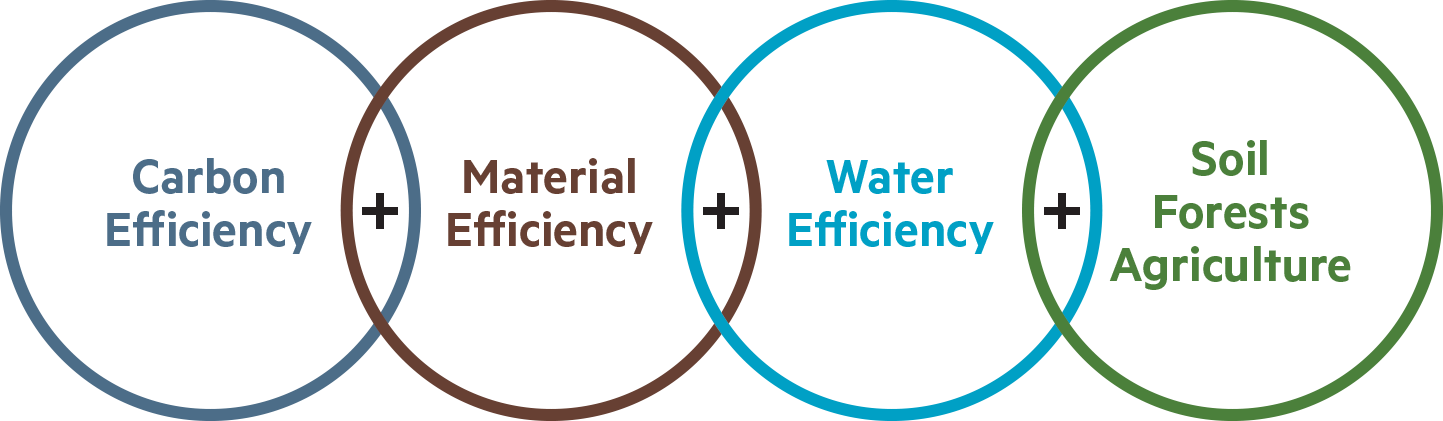

EP analysis is a way of measuring a company’s efficiency of operations—similar to labor productivity or to other ratios measuring operational efficiency. Specifically, it involves the analysis of a company’s relative efficiency in its use of and impact on natural resources (for example, carbon, water and raw materi- als). Using environmental data as part of the research process to find the most well-managed companies is simply a better way to create an investment portfolio; one that will yield better risk-adjusted returns against comparable broad market indices. Regulatory changes also support this proposition. (See “Integration Into Policy,” p. 32.)

Read full story at »