Press Release

BOSTON (December 6, 2017) Terra Alpha joins the sustainability nonprofit organization, Ceres, in releasing the first-ever, comprehensive, online toolkit for investors to evaluate and understand water risks.

The Ceres Investor Water Toolkit was produced in partnership with over 40 investors from Ceres Investor Water Hub, a working group of more than 90 global institutional investment firms within the Ceres Investor Network on Climate Risk and Sustainability. Members producing the toolkit collectively manage $6 trillion in assets.

For the past several years, the World Economic Forum has ranked water as a top global risk, due to competition for dwindling resources, climate change and weak governance. The increasingly extreme nature of water-related weather events, and the tendency for local communities to react swiftly to existing or perceived corporate impacts on water supplies, drive the immediacy of water risks.

Water efficiency is one of the Environmental Productivity measures Terra Alpha uses in choosing stocks for our portfolio. We believe companies (and their investors) that proactively assess the exposure of both their direct operations and global supply chain to water-associated risks will have a competitive advantage over their peers and be more successful in the long term.

“Investors are increasingly focused on water risks in their portfolios. The immediacy of these risks can mean total value destruction overnight,” says Monika Freyman, director of investor engagement on water at Ceres. “The Ceres Investor Water Toolkit closes a critical gap for institutional investors who have long sought a how-to-guide for integrating water risks into portfolio management and decision- making.”

The Ceres Investor Water Toolkit also includes the following elements:

• Five “Toolkit” modules covering the following topics:

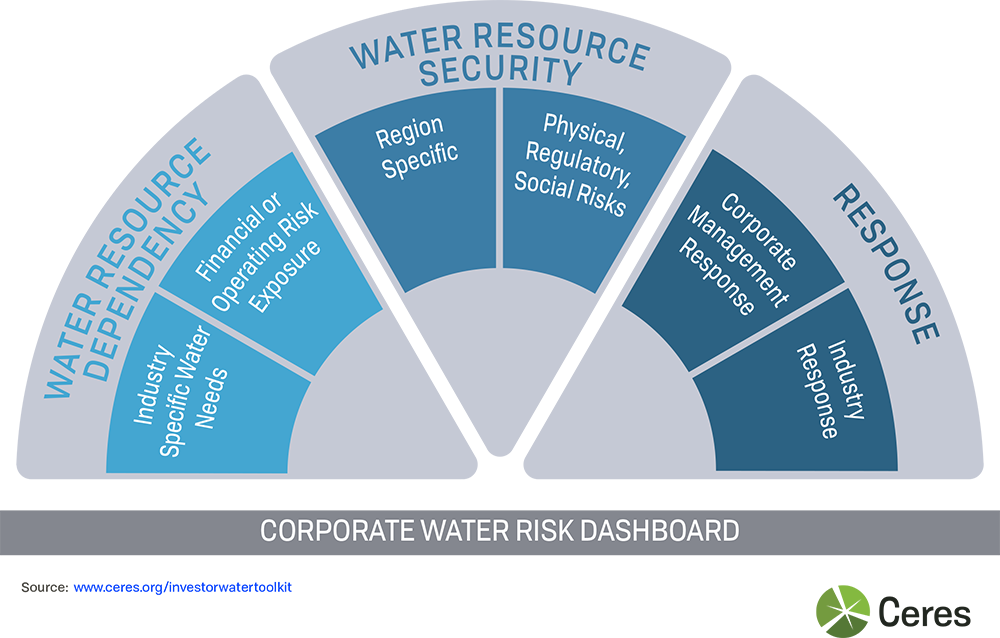

- 1) Understanding and evaluating material water risks

- 2) Establishing water-related investment priorities and integrating them into decision- making

- 3) Buy/sell analysis (methods for embedding water risk into daily decision making)

- 4) Portfolio and asset class analysis of water including water risk heating mapping and portfolio footprinting case studies.

- 5) Engagement resources and trends related to water

- A summary of many existing datasets, tools and resources related to corporate water risks out in the market

- Recommendations and methodologies for analysing water risks by asset class, including private equity and municipal bonds with associated water-engagement questions

- Numerous datasets, resources and case studies written by investors showcasing real world examples of water risk integration, such as case studies by SBA Florida and ACTIAM delineating their water footprinting techniques. Other case studies, such as by the Park Foundation, showcase how to strive for investment water goals and priorities, while others highlight how to use scenario analysis and water risk modeling (Citi) or how to take a systems-approach to managing water risks (TIIP). About Terra Alpha Investments: Terra Alpha Investments is a global investment management company that believes a portfolio of the world’s most fundamentally strong, attractively-valued, and environmentally-productive companies will provide investors with superior long-term, risk-adjusted returns, and advocates to bring the economic system into greater alignment with the natural systems. The firm utilizes 75+ combined years of successful, traditional investment experience with a hybrid research approach to select equities for its portfolio, and has generated attractive financial and environmental returns since its launch in 2015.