Veris Wealth Partners

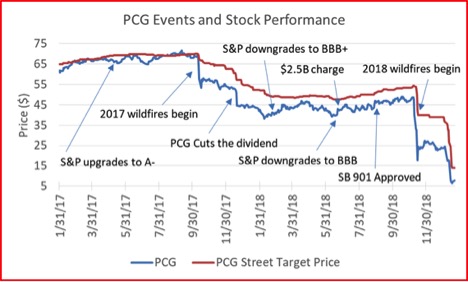

Pacific Gas & Electric (PG&E) Corporation, California’s largest investor-owned utility, which serves roughly 5.2 million households in central and northern California, filed for bankruptcy and is facing an estimated $30 billion of potential liabilities stemming from its equipment’s role in the historic 2017 and 2018 wildfires.

PG&E’s bankruptcy is indicative of how our changing climate presents real economic and financial risks for companies and investors. Prior to the wildfires that burned over 240,000 acres, PG&E included warnings that weather-related disasters could weigh on or disrupt its operations in its regulatory filings. In a statement, the company noted that the state’s most recent climate assessment “found the average area burned statewide would increase 77 percent if greenhouse gas emissions continue to rise,” and that “prolonged drought and higher temperatures will triple the frequency of wildfires.” Further, PG&E performed extensive water risk assessments, water management was integrated into its business strategy, and the company spent hundreds of millions of dollars every year in fire prevention, including pruning or removing thousands of trees. This awareness and action, though necessary and important, was not enough.

In an environment that continues to be challenged by climate change, PG&E’s situation could be a harbinger of the economic toll of spatially-related climate risk. “California is now a riskier place to do business,” said the Environmental Defense Fund’s Michael Colvin, a former adviser to the California Public Utilities Commission. “This is a statewide problem.”

Read full story at Veris Wealth Partners »